Get This Report on Okc Metro Group

Table of ContentsThe Buzz on Okc Metro GroupNot known Details About Okc Metro Group An Unbiased View of Okc Metro GroupThe 5-Minute Rule for Okc Metro GroupLittle Known Facts About Okc Metro Group.

By leveraging the purchase of a financial investment residential property, the required periodic payments to service the financial obligation produce an ongoing (and occasionally huge) unfavorable cash circulation starting from the moment of purchase. This is sometimes referred to as the bring price or "carry" of the financial investment. To be successful, genuine estate investors should manage their capital to produce enough favorable revenue from the property to a minimum of balance out the carry prices. [] In the USA, with the finalizing of the JOBS Act in April 2012 by Head Of State Obama, there was an easing on investment solicitations.

Fundrise was the first business to crowdfund a realty financial investment in the USA. Realty homes might produce profits with a variety of methods, consisting of net operating earnings, tax obligation shelter - https://medium.com/@danielnorthrup73008/about offsets, equity build-up, and funding admiration. Web operating income is the sum of all benefit from rental fees and various other sources of regular earnings produced by a property, minus the amount of recurring expenditures, such as maintenance, energies, charges, taxes, and other expenditures.

5 Easy Facts About Okc Metro Group Explained

These can be marketed to others for a cash money return or various other advantages. Equity build-up is the rise in the financier's equity proportion as the part of financial debt service repayments devoted to principal accrue over time. Equity accumulation counts as favorable capital from the property where the debt solution payment is made out of income from the home, instead of from independent earnings sources.

Funding appreciation can be very unpredictable unless it belongs to a development and enhancement approach. The acquisition helpful site of a residential or commercial property for which most of the forecasted cash circulations are anticipated from capital appreciation (prices going up) as opposed to other resources is taken into consideration speculation (Luxury homes in Oklahoma City) instead of investment. Research results that located that property firms are most likely to take a smaller sized risk in larger properties when spending abroad (Mauck & Cost, 2017).

Not known Facts About Okc Metro Group

Quality at this stage are called Realty Owned, or REOs. As soon as a property is cost the foreclosure public auction or as an REO, the lending institution may keep the earnings to satisfy their mortgage and any kind of legal expenses that they sustained minus the prices of the sale and any kind of outstanding tax commitments.

Routledge Buddy to Real Estate Investment."China stores 70% of its wealth in actual estate. Commercial Building Valuation: Methods and Instance Researches.

An Unbiased View of Okc Metro Group

Glickman, Edward (14 October 2013). Academic Press. Troubled Real Estate Institute.

Portman, Janet (7 February 2008). "Foreclosure causes heartache for tenants". Inman News. Recovered 24 February 2008. Eisen, Ben (9 December 2018). "Real Estate Stagnation Agitates the Fix-and-Flip Crowd". WSJ. Recovered 15 October 2019. "Exactly how young financiers are chasing very early retirement". Albany Organization Evaluation. Obtained 15 October 2019. Greene, David (16 May 2019).

Trainees speak Realty at the Jindal College Working in real estate is a rewarding, satisfying, satisfying, hands-on profession alternative - Oklahoma City Heritage Hills. Individuals and businesses are getting, marketing and leasing building on a daily basis and they require well-read, out-going specialists to aid them fulfill their goals. Roughly one in six tasks in the United States remain in property and the job alternatives are many

How Okc Metro Group can Save You Time, Stress, and Money.

Job abroad, in a city, major cities or country communities. Below are ten reasons you should start examining property in an academic setting with the Undergraduate or Graduate Actual Estate program in the Jindal School of Monitoring at UT Dallas. Real Estate is essential to the USA economy, adding around 20% to the united stateAcross the nation, industrial realty developed and supported 9.2 million work in 2019 and added $1.14 trillion to its GDP (reported by DBJ March 2020). The property industry has actually constantly been a vital part of the Texas economic situation and that is still true today. Professionals that can execute monetary evaluation for real estate investments, evaluate danger and facilitate financing remain in need.

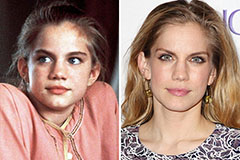

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Mara Wilson Then & Now!

Mara Wilson Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!